Renewed the reconstructing bonus in 2020

The budget law, approved by the Government shortly before the end of the year, provided a full package of incentives and deductions for taxpayers, including the extension of the significant “Bonus Ristrutturazioni” (“Reconstructing bonus”) addressed also to all the works that have to be carried out until the 31st December 2020.

The advantage consists of the possibility to benefit from the PIT (in Italian IRPEF) deduction of 50% of the costs incurred, up to a maximum of EUR 96.000 for each individual property unit.

Who can take advantage of the benefits

All taxpayers subject to the IRPEF (personal income tax), not only property owners, but also holder of real or personal rights of enjoyment of the real estate, which is the object of the interventions, and which bear the related expenses, have the right to benefit from the deduction:

- Owners or bare owners;

- Holder of real right of enjoyment of properties (usufruct, use, housing or surface);

- Lessees or borrowers

- Members of cooperatives

- Individual entrepreneurs (for properties not falling into the categories of capital goods or goods);

- Individuals mentioned in article 5 of the Income Tax Code (in Italian TUIR), who produce income in an associated form (ordinary partnerships, copartnerships, limited partnership and subjects treated as such, family businesses), under the same conditions laid down for individual entrepreneurs..

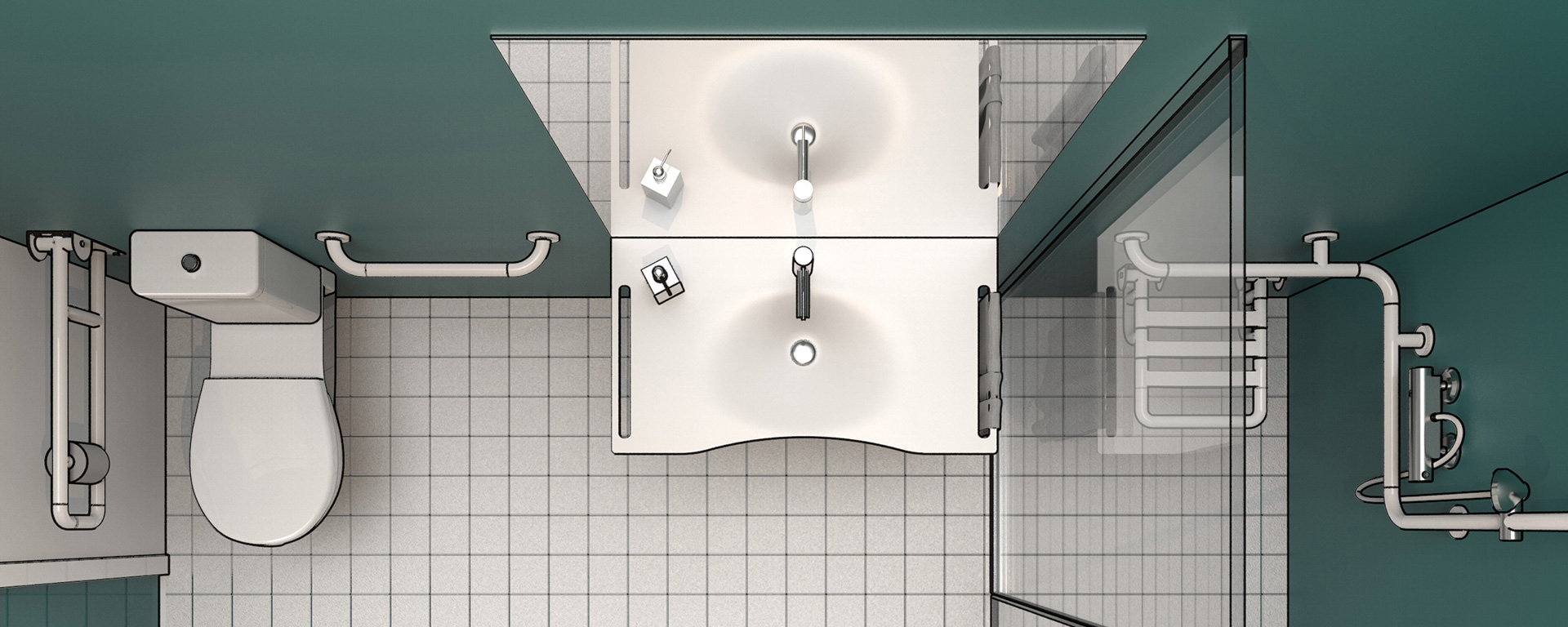

This means, for instance, that if a person has to completely reconstruct the plumbing system of his bathroom, he may benefit, including the change of his bathroom fixtures (consisting in changing the tub with another tub provided with a door, or a shower-box), of the 50% deduction for which the entire intervention is available up to a maximum of EUR 96.000.

For more information, you can read our “Tax Guide for Renovations”.“.